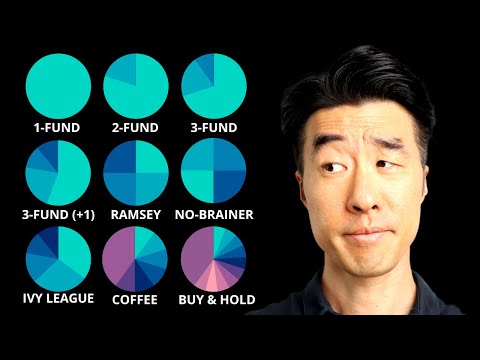

When it comes to investing portfolio strategies, there are countless options available. So which one is right for you? In this video, we’ll take a look at nine of the most popular investment portfolio strategies and explore what each one entails. Which strategy will you choose?

Timecodes:

0:00 – Intro

1:55 – 1-Fund Strategy

3:16 – 2-Fund Strategy

4:16 – 3-Fund Strategy

5:34 – 3-Fund (+1) Strategy

7:02 – Dave Ramsey 4-Fund Strategy

8:31 – Bill Bernstein’s No Brainer Portfolio

9:45 – Ivy League Endowment Strategy

10:59 – The Coffee House Portfolio

12:05 – The Ultimate Buy & Hold Portfolio

————

FAVORITE TOOLS:

► Mint Mobile – Check Out My Partner Mint Mobile, Affordable Phone Service –

► SoFi – Checking & High-Yield Savings Account (Terms Apply) – (Affiliate Link)

► Shortform – More Than Book Summaries –

LINKS:

► Get My Weekly Newsletters:

► Favorite Books:

DISCLAIMER: I am not a financial adviser. These videos are for educational and entertainment purposes only. I am merely sharing my personal opinion. Please seek professional help when needed.

for my tax advantaged accounts I follow a single target retirement date fund approach, keeps it simple and will balance risk as the fund matures. in my taxable brokerage accounts I follow a 3 fund strategy with an occasional 4th fund tilt for “short term” earnings

Excellent overview! I agree that simplicity is key. For most long-term wealth builders, the Bogleheads three-fund portfolio [04:15] seems like the most robust, low-cost, and easily rebalanced strategy, eliminating the headache of trying to choose between 9+ options. Thanks for the breakdown!

Great information. Thank you.

Coffee house and Ultimate Buy and Hold are both 60/40 Portfolio.

1st strategy – 1 fund portfolio

2nd strategy – 2 fund portfolio

hmmm… I see a pattern emerging here

3rd strategy – 3 fund portfolio

let me guess – 9th strategy – 9 fund portfolio